On September 29, 2024, FiinRatings, a leading credit rating agency in Vietnam and a technical partner of S&P Global Ratings, upgraded Coteccons’ long-term credit rating from BBB to BBB+ with a “Stable” outlook.

This recognition is a proud achievement for Coteccons after three years of restructuring and operational stabilization. The company has consistently improved its profitability, operational efficiency, and the quality of its receivables by shifting towards projects with stronger cash flows, especially FDI projects.

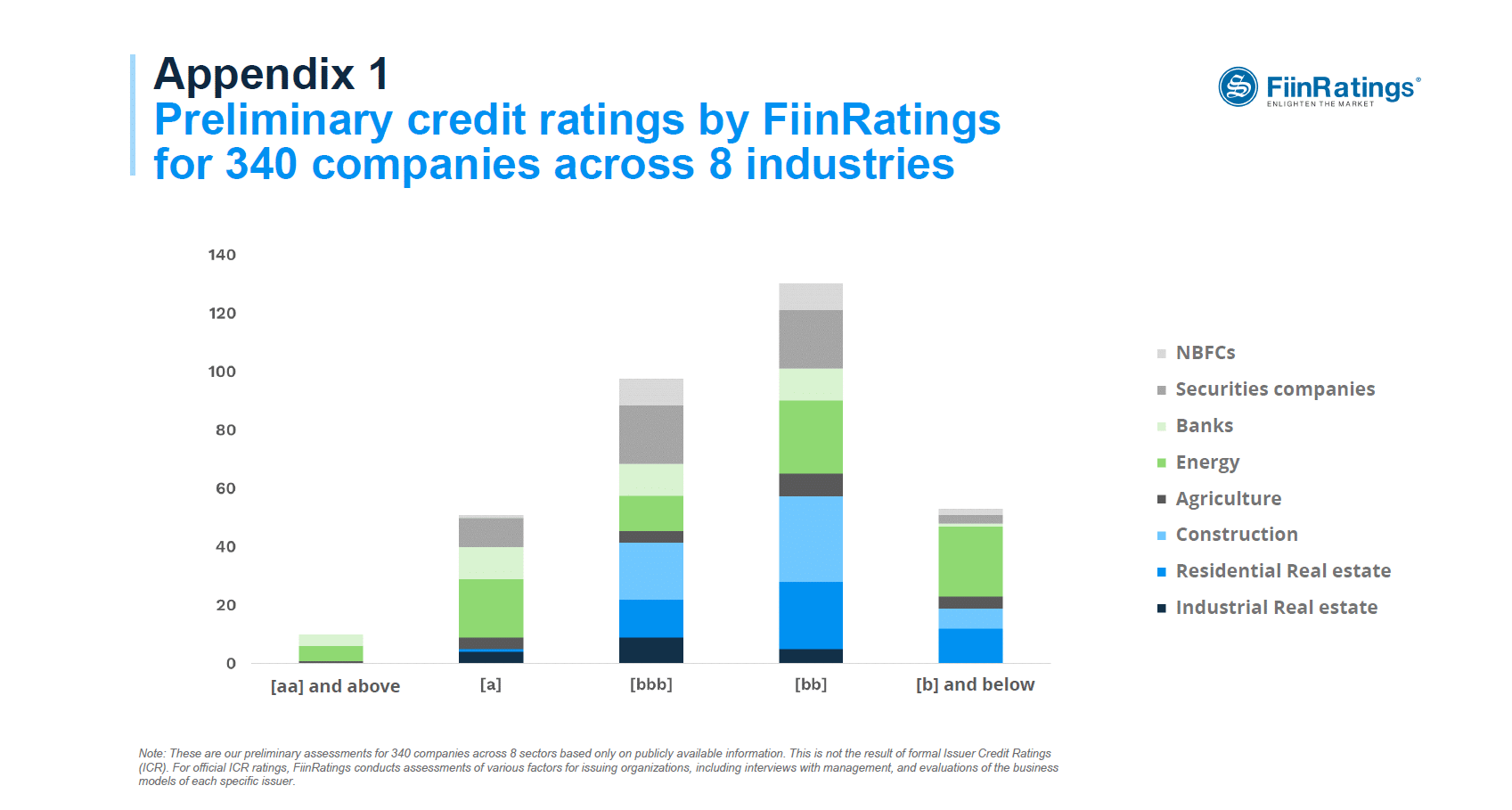

This result is particularly meaningful as the A-category ratings are typically reserved for energy companies and banks, and no construction company has ever been rated in this group. Coteccons is also the only construction company to achieve a BBB+ rating, the highest in the B-category.

Source: Vietnam Corporate Bond Market Research Report, FiinRatings

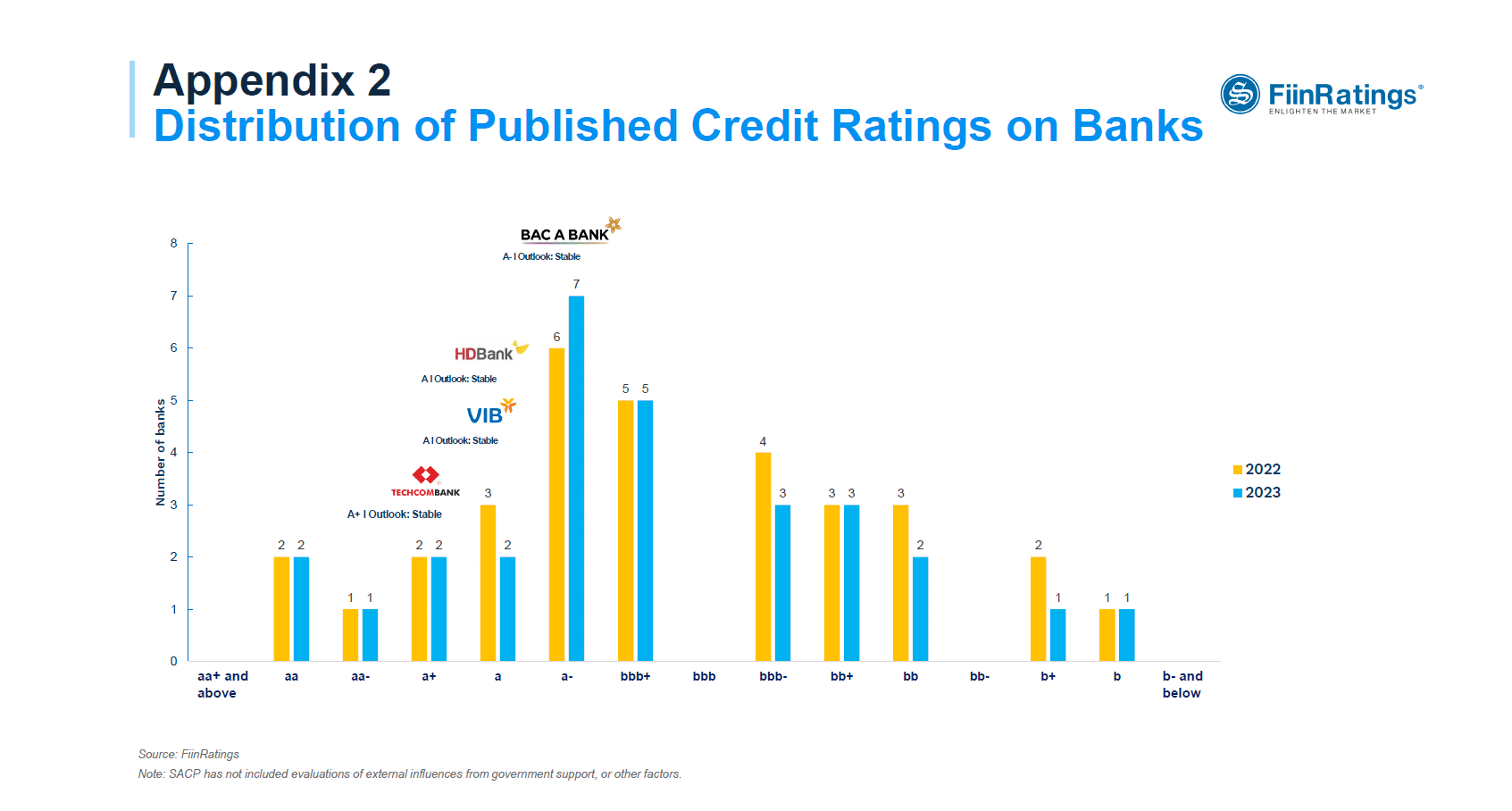

When compared to organizations in the banking sector, Coteccons’ credit rating is on par with or higher than 15 credit institutions (according to 2023 data from FiinRatings).

Source: Vietnam Corporate Bond Market Research Report, FiinRatings

According to FiinRatings, “Coteccons has shown remarkable resilience in maintaining its leading position following the restructuring phase, despite the high-risk nature of the construction industry and challenging macroeconomic conditions. This resilience is reflected in its strong and sustained growth in revenue and backlog, along with notable and consistent improvements in profit margins, operational efficiency indicators and account receivables quality.”

Ambition to Become a “Unicorn” in Construction with “Gazelle-Like” Performance

By the end of FY2024, Coteccons achieved a revenue of VND 21,045 billion, a 30.8% increase compared to the previous year. Gross profit nearly doubled, reaching VND 713 billion. Audited net profit reached VND 310 billion, a 358% increase compared to FY2023, completing 113% and 8% of the old (VND 274 billion) and new (VND 288 billion) business plans, respectively. The FY2024 gross margin was 3.39%, the highest since 2022, following the end of the Covid-19 pandemic.

Coteccons’ total assets currently amount to VND 22,869 billion (audited), a 7% increase compared to FY22-23, with cash and short-term investments of approximately VND 4,000 billion, equivalent to ~18% of total assets, ensuring a strong financial foundation despite ongoing challenges in the construction industry.

In addition, Coteccons boasts a substantial backlog of VND 30,000 billion for the upcoming years, with a specific backlog of VND 20,000 billion for FY2025, signaling positive signs of market recovery and providing a solid foundation for achieving next year’s business plans.

With a target of achieving a compound annual growth rate (CAGR) of 20-30% over the next five years, Coteccons is steadily and confidently reaching key milestones on this journey through six strategic priorities:

Strategic Priority 1: Maintain leading position and growth in the core civil construction business, establishing a solid foundation for industrial construction growth and laying the groundwork for infrastructure construction.

Strategic Priority 2: Expand into international markets and explore new business sectors. These new sectors must clearly contribute to both revenue and profit growth.

Strategic Priority 3: Effectively increase profit margins. All departments must actively research and implement innovations, invest in new equipment, and adopt new technologies to continuously improve operational efficiency and optimize profit margins.

Strategic Priority 4: Restructure the system and enhance organizational capabilities—building a foundation for sustainable business development. Create a flexible operation with a professional workforce, ensuring both quality and quantity.

Strategic Priority 5: Build a leading industry brand—Industry Leader, aiming for global brand recognition. This mission elevates the standards of the entire construction industry, initiating and contributing real value to socioeconomic development, serving the long-term interests of the community.

Strategic Priority 6: Develop sustainably based on a strong ESG framework that runs throughout the company’s operations.

FiinRatings’ upgrade of Coteccons’ credit rating to BBB+ is not only a testament to the company’s remarkable efforts and achievements but also opens up new and promising opportunities. With extensive experience in project execution and management, a solid financial position, and clear strategic goals, Coteccons aims to become the “Industry Leader” in Vietnam’s construction sector, helping lift the industry to international standards.

For more details on Coteccons’ credit rating results, please visit: https://fiinratings.vn/RatingDetail/2096